Airdrop & Liquidity Mining 02 - CAC

Summary

- We find out that airdrop CAC range from $1,000 to $10,000

- Such CAC is much higher than traditional financial institutions at $50 to $1500. This reflects the crypto market's focus on early adopters and its smaller TAM.

- Most protocols do not pay much attention to CAC as they simply see it as a way to build a strong community and bootstrap their network in the early days.

- Though we agree it is also important to have an understanding of it and iterate on token distribution using quick feedback loops with systems such as onchain quests in order to avoid growth challenges.

- We recommend protocols not do to one major airdrop and instead to have many microairdrops using data-driven strategy to build a strong holder base

- Sixdegree can help you build such strategy with Rabbithole infrastructure. Read about our case study with ParaSwap using RabbitHole and onchain quests.

- Contact us as [email protected] and Follow us on Twitter

2.4 CAC Analysis

2.4.1 Definitions

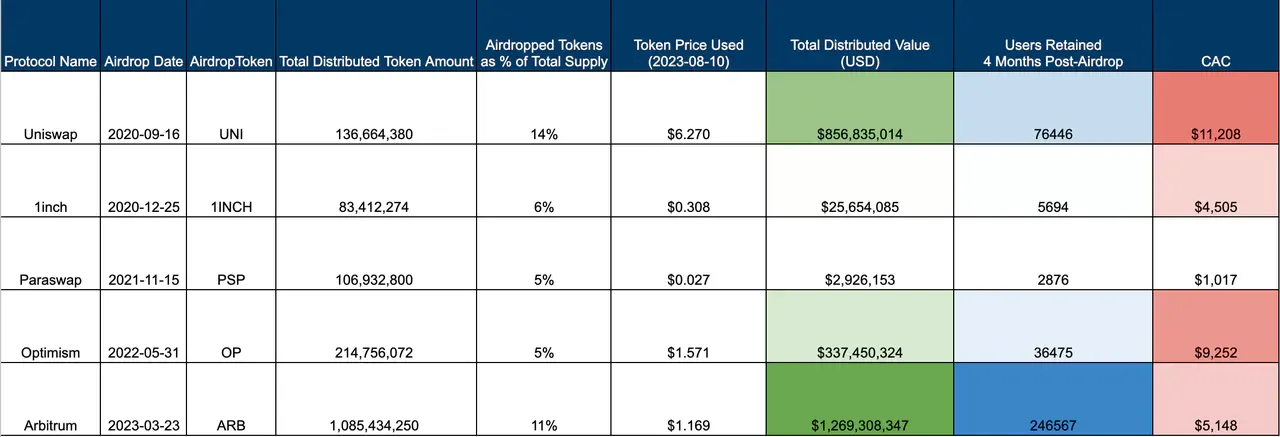

CAC = airdropped token value / retained users post-airdrop

airdropped token value = airdropped tokens * current price (as of 2023-08-10)

- We use the current price of the token here, as we believe it should be a price that is close to the intrinsic value of the token. Considering that the price will be pushed to an unreasonable position due to FOMO sentiment during airdrops, we ultimately chose the current price, which has been fully priced after a long period of market competition.

retained users post-airdrop = active users in the 4th month after airdrop

- Each address is considered as a unique user.

- Four months have passed since the Arbitrum airdrop. For protocol comparison, we're using the 4th month's performance as our metric.

2.4.2 CAC for Different Protocols

In the previous section, we discussed the retention rates of users who received airdrops from different projects. If we view token airdrops as a customer acquisition strategy, we can calculate the CAC for each project. Here, we choose the users who remained after the fourth month post-airdrop as the effective users retained from the token airdrop.

- Despite Uniswap's airdropped users having a high retention rate in the fourth month, Uniswap paid a substantial cost for this (in Uni tokens), resulting in a staggering CAC of $11,208. Given that Uniswap was a pioneer in the airdrop mechanism, it's understandable that their airdrop rules weren't meticulously designed. Additionally, we can't solely evaluate based on the number of users and perhaps a high CAC is accompanied by a significant liquidity contribution to Uniswap.

- Both Arbitrum and 1inch have CACs around $5,000. Considering that Arbitrum's airdrop scale was much larger than 1inch's, it's evident that Arbitrum exhibited better performance.

- Considering that both Arbitrum and Optimism are L2 solutions, they are more comparable. Arbitrum outperforms Optimism in terms of retained users from the airdrop as well as CAC.

- Due to Paraswap's overall smaller airdrop scale and their more meticulously designed airdrop rules, they achieved a relatively favorable CAC, around $1,000.

2.4.3 CAC VS Traditional Financial Institution

- From a CAC perspective, Crypto Protocols incur a higher user acquisition cost via airdrops than traditional banks. Even the best performer, Paraswap, matches only the most expensive banks.

- However, this is reasonable. The higher CAC cost is driven by the relative early stage of the market and the focus on acquiring early adopters, which by definition have a higher CAC.

- Airdrop was first thought of as a single event in which it should not only create incentive for early adopters but also medium to long term adopters. The introduction of token incentives can indeed rapidly attract users in the early stages of development.

- Given the increasingly fierce competition, Crypto Protocols need to move away from broad-brush user growth strategies. Instead, they should leverage token incentives for more refined user growth and operations.

- Data-driven business growth is an inevitable path, and this approach has already been proven effective in traditional internet companies.

About Sixdegree

- Sixdegree is a crypto-native onchain research firm that specializes in incentive optimization for protocols to enhance user growth

- We have worked with 25+ protocols including Lens, Gnosis, ParaSwap among others

- We are also working on solving onchain attribution problem

- We are Ethereum Foundation grantee for our research on account abstraction

- We have been selected by Nansen as research partner

- Contact us if you want to talk about onchain data, onchain growth among others at [email protected]

- Follow us on Twitter