Airdrop & Liquidity Mining 01 - Retenion

00. Summary for Twitter

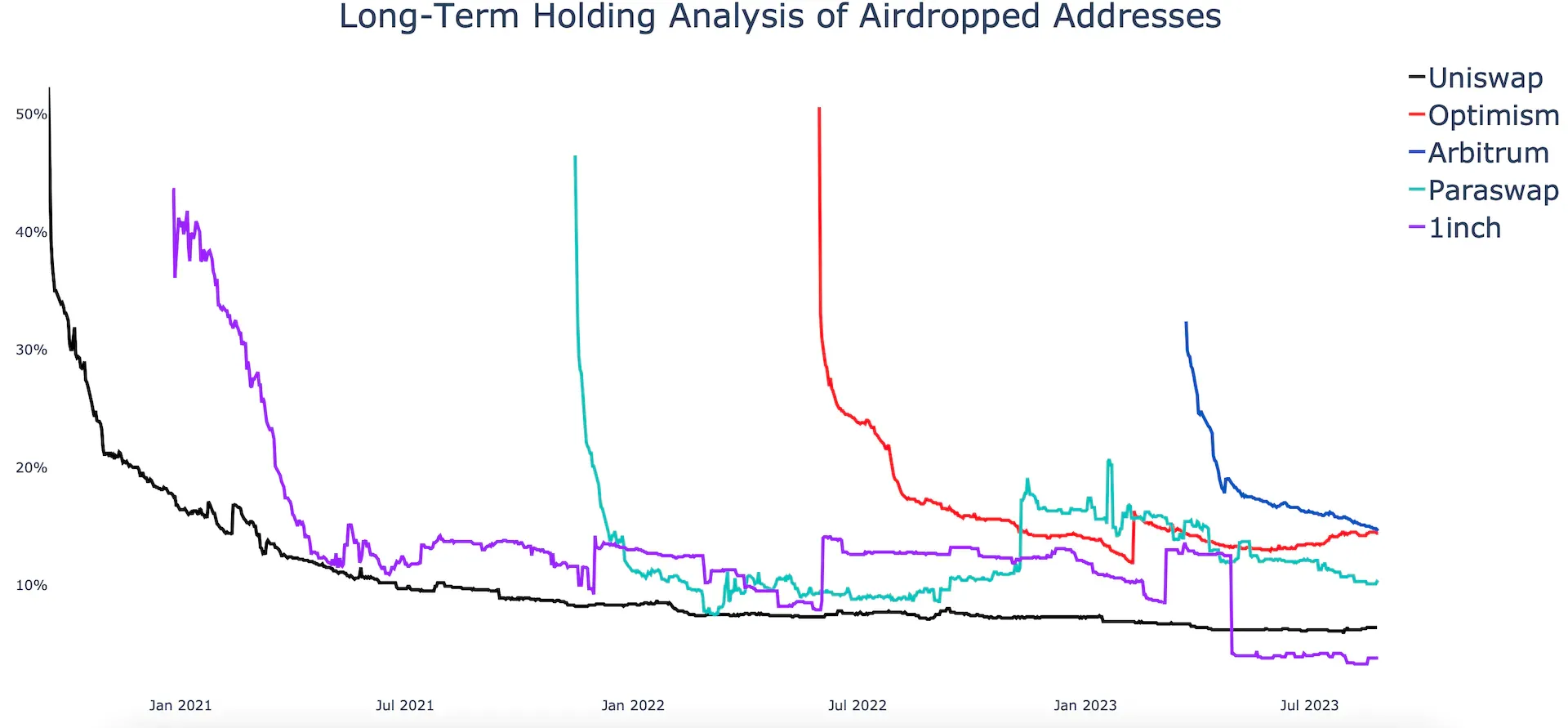

- Airdrops have an average churn of 80% after four months even for top protocols

- Selected airdrops including 1inch, Uniswap, Optimism, Arbitrum and ParaSwap have a retention rate under 20% after four months and under 15% after 12 months

- The churn slowed down after the four month and remained stable for the best ones (e.g. Optimism) or continued to decrease for the less quality ones

- A good airdrop strategy can prevent the token holding rate from entering a long-term decline.

- Optimism's Airdrop Round 2 is a notable example where the holding rate curve of saw a noticeable increase on 2023-02-09 related to their Airdrop Round 2. Airdropped users are holding OP!

- We recommend protocols not to do one major airdrop and instead to have many microairdrops using data-driven strategy to build a strong holder base

- Sixdegree can help you build such strategy with Rabbithole infrastructure. Read about our case study with ParaSwap using RabbitHole and onchain quests.

- Contact us as [email protected] and Follow us on Twitter

0. Introduction

- Welcome to the first installment of our series of data-driven articles. In this series, we aim to dissect the two pivotal token distribution mechanisms in the crypto sphere: airdrops and liquidity mining.

- Our primary objective is to understand these mechanisms from the viewpoint of user growth, examining how they contribute to the protocols' long-term value and usefulness in the crypto economy

- While both liquidity mining and airdrops are strategies for user growth in protocols, they emphasize different aspects. Specifically, for DEXs, the ultimate goal of liquidity mining is to enhance the liquidity of pools, while the objective of airdrops is to encourage users to use the product as much as possible.

If we eventually unify both approaches from the perspective of retaining users (addresses), we can attempt to compare them.

- The granularity of an airdrop strategy can impact the final user retention rate. Pioneers of airdrop events had somewhat crude designs for their airdrop schemes.

- Subsequent protocols, emulating these pioneers, optimized their airdrop strategies, resulting in higher retention rates and a lower Customer Acquisition Cost (CAC).

- In comparison to meticulously designed airdrop strategies, early designs for liquidity mining were rudimentary. When we compare its CAC with that of airdrops, it tends to be on the higher side.

In this first chapter, we focus on airdrop retention. Please see below some key findings:

- The aidrop retention seems to drop substantially until the 4th month and then remained somewhat stable for the best ones (e.g. Optimism) and then continued to decrease for the less quality ones (e.g. 1inch)

- A good airdrop retention rate seems to be above 20% after the 4th month and 15% after the 12 months.

- Most airdropped tokens are not held for the long term. Nearly all protocols see their token holding rate eventually drop to below 20%. A good airdrop strategy can prevent the token holding rate from entering a long-term decline, and Optimism's Airdrop Round 2 is a notable example:

Background

Welcome to the first instalment of our series of data-driven articles. In this series, we aim to dissect the two pivotal token distribution mechanisms in the crypto sphere: airdrops and liquidity mining.

Our primary objective is to understand these mechanisms from the viewpoint of user growth, examining how they contribute to the protocols' long-term value and usefulness in the crypto economy. Central to our investigation are the metrics of CAC, retention, and the Lifetime Value (LTV) of a customer.

Through meticulous analysis, we will shed light on how airdrops and liquidity mining individually and comparatively influence these key indicators. In this inaugural article, our focus narrows to the user retention rate and CAC.

We will explore some of the industry's most notable projects: Uniswap, 1inch, Paraswap, Arbitrum, and Optimism, gleaning insights into how these projects utilize airdrops and liquidity mining to drive sustainable user growth.

Airdrop Analysis

- 2.1 Retention Analysis

- 2.1.1 Definitions

- There are two distinct definitions of retention rate we use:

- Each address is considered as a unique user.

- Chain Retention: if a user makes a transaction on a specific chain in any month post-airdrop, they're considered a retained user for that month on that chain.

- Project-Specific Retention: when a user interacts with a project's core contract (e.g., Uniswap, or any other project) at any month after the airdrop, they're deemed a retained user for that month.

For a detailed definition of retention rate and information on which contract-related data from the project is included in the retention statistics, please refer to the Google sheet below. https://docs.google.com/spreadsheets/d/1hFMvaJOm8ASUNUH-ZV7eiwzKB2CkrRKJBWS3f8rPpXU/edit#gid=0

2.1.2 Retention Cohort Chart

- We aim to observe over as long a period as possible, but since Arbitrum only has data for four complete months, we are limited to considering the fourth month.

- Based solely on the fourth month after the airdrop, Arbitrum (42%) and Uniswap (34.6%) demonstrate better user retention; both Optimism and Paraswap hover around 20%, while 1inch has the lowest performance at just 13%. For 1inch the token airdrop used to incentivize users did not result in long-term user stickiness.

- The 'airdrop month' proportion is closely tied to distribution timing. Notably, 1inch's proportion is notably low due to the airdrop commencing towards the end of the month. Additionally, attention plays a crucial role. During Optimism & Arbitrum's airdrops, the absence of competing hot topics directs people's focus primarily towards the airdrop activities.

- Note, given the inability to conduct a strictly rigorous controlled experiment, we've chosen to use the airdrop month as a baseline, defining the retention rate as the proportion of retained users in the Nth month following the airdrop compared to the total airdropped users. An underlying assumption here is that we're disregarding external environmental effects on user retention (e.g., retention rates are likely higher during a bull market compared to a bear market).

2.3 Long-Term Holding Behavior Analysis

2.3.1 Definitions

Holding Rate = Tokens held by claiming addresses / Total claimed tokens

- We use the Holding Rate to observe if the addresses receiving airdrops tend to hold onto the tokens they receive for the long term. This way, we can get a general idea of how people are handling the received airdrops.

- Recognizing that not holding onto tokens doesn't always imply selling is crucialg. Tokens could be transferred to new wallets, used for staking, or involved in diverse processes. While it's challenging to accommodate all scenarios, this simplified approach still allows us to draw conclusions that are close to reality.

- 2.3.2 Holding Rate for Different Protocols

- In the long run, the holding rate of all addresses that received airdrops is gradually decreasing, and will eventually drop to below 20%.

- As one of the earliest protocols to initiate airdrops, Uniswap has shown a steady decline curve, without any significant rebounds. This indicates that those who received the airdrop have little interest in holding Uniswap. This might be related to Uniswap's token model (purely a governance token).

- The holding rate of 1inch experienced several rebounds during its decline (on 2021-12-01, 2022-06-03, and 2023-03-07). Upon verification, I found that the abnormal fluctuations are related to the token vesting of $1inch. Among the addresses that were airdropped 1inch, there was one address(0x46eea8d5b37d2db51f35c1bc8c50cbf80fb0ffe5) that obtained a large number of tokens multiple times through vesting.

- The behavior of whales has a significant impact on the holding rate curve. For Paraswap, two strong rebounds (on 2022-11-10 and 2023-01-19) were related to whales, one of which was an address associated with the Fantom Foundation.

- The holding rate curve of Optimism saw a noticeable increase on 2023-02-09, which is related to their Airdrop Round 2.

- We can clearly observe that the holding rate for these airdropped addresses did not decline rapidly. To some extent, this implies that Airdrop Round 2 had a better effect than Round 1, with tokens being distributed to more suitable users. This is largely related to the different strategies adopted by Optimism for the two airdrop rounds.It is recommended that protocols planning future airdrops pay close attention to and study the detailed rules of Optimism's Round 2.

About Sixdegree

- Sixdegree is a crypto-native onchain research firm that specializes in incentive optimization for protocols to enhance user growth

- We have worked with 25+ protocols including Lens, Gnosis, ParaSwap among others

- We are also working on solving onchain attribution problem

- We are Ethereum Foundation grantee for our research on account abstraction

- We have been selected by Nansen as research partner

- Contact us if you want to talk about onchain data, onchain growth among others at [email protected]

- Follow us on Twitter