Half Year Data Report of Account Abstraction - ERC4337

Executive Summary

- We are thrilled to witness the introduction of ERC4337, representing a significant advancement in the Ethereum account system. This report offers a data-driven analysis of the adoption of ERC4337 and an outlook on the market and its market participants.

- ERC4337 has the potential to become an essential pillar for broader user adoption of on-chain games, social networks and other consumer applications.

- More than 687K AA wallets have been created and over 2 million UserOps have been initiated since the deployment of ERC4337 smart contracts.

- The majority of growth took place in July and August, with a focus on Layer2 networks such as Polygon, Optimism, and Arbitrum. CyberConnect and ZTX attracted the most new users and onchain activity.

- Account activity levels are relatively low, 88.24% of AA wallets are used five times or less. Most behaviors observed are either direct transfers or minting NFTs.

- There are currently 1.5K bundlers, Pimlico holding the largest market share at 43.48%. However, Alchemy generated the highest revenue, approximately $20K since the launch of ERC4337.

- 97.18% of bundled transactions consist of only one UserOp(a new transaction type describes a "transaction" to be sent by Bundler on behalf of AA Wallet), indicating that there aren't enough UserOps to fully leverage the benefits of bundling. As a result, 90% of bundlers are not profitable.

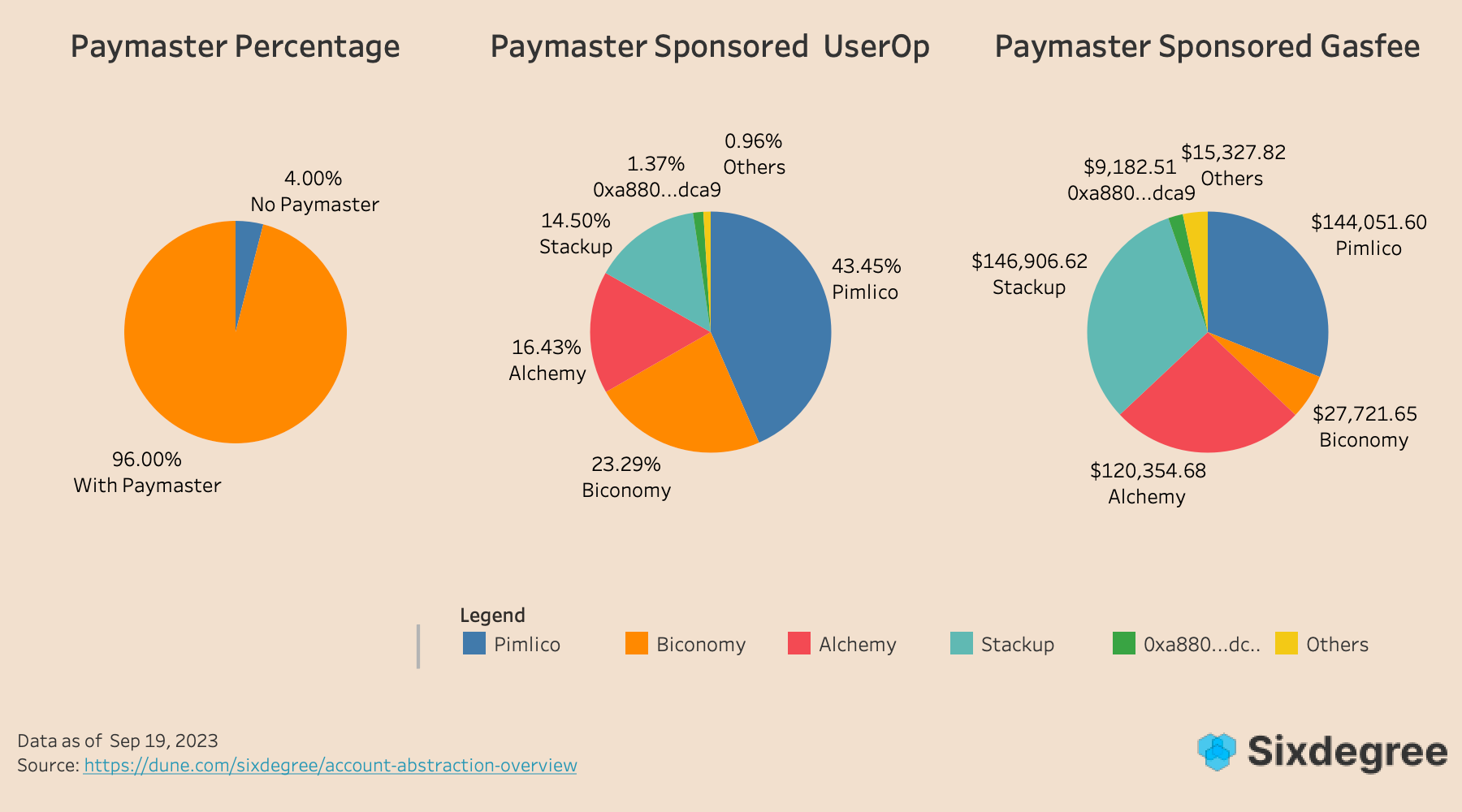

- 96% of UserOp have had their gas fees paid by Paymaster, suggesting that most dApps have implemented this optional feature in ERC4337.

- A total of 117 paymasters(who can pay gas fees on the behalf of the user) have generously sponsored $465K in gas fees, supporting approximately 19 million UserOps. Pimlico has emerged as the largest contributor, covering 43.45% of the total gas fees.

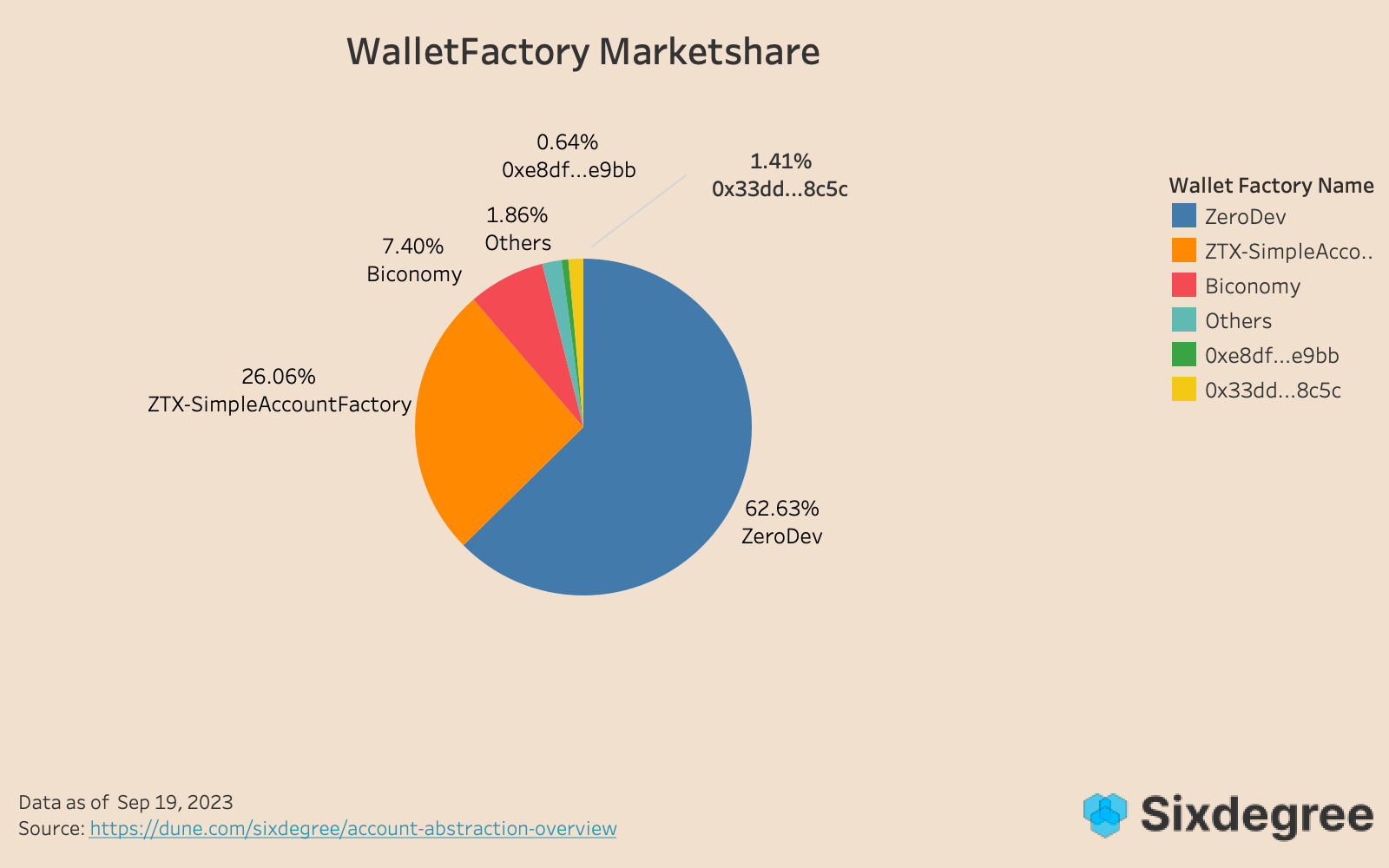

- ZeroDev dominates the Wallet Factory market share, holding a majority stake of 62.63%.

- The most common way for each application to build their AA is in the LEGO way, i.e., adopting Bundler, Paymaster, Wallet Factory from different third-parties, while building everything from the ground needs more time and effort

- We anticipate an increasing number of upcoming apps adopting ERC4337. This will facilitate significant advancements in the Ethereum account system.

For the PDF version, please download from the following link.

A Quick Overview of ERC4337

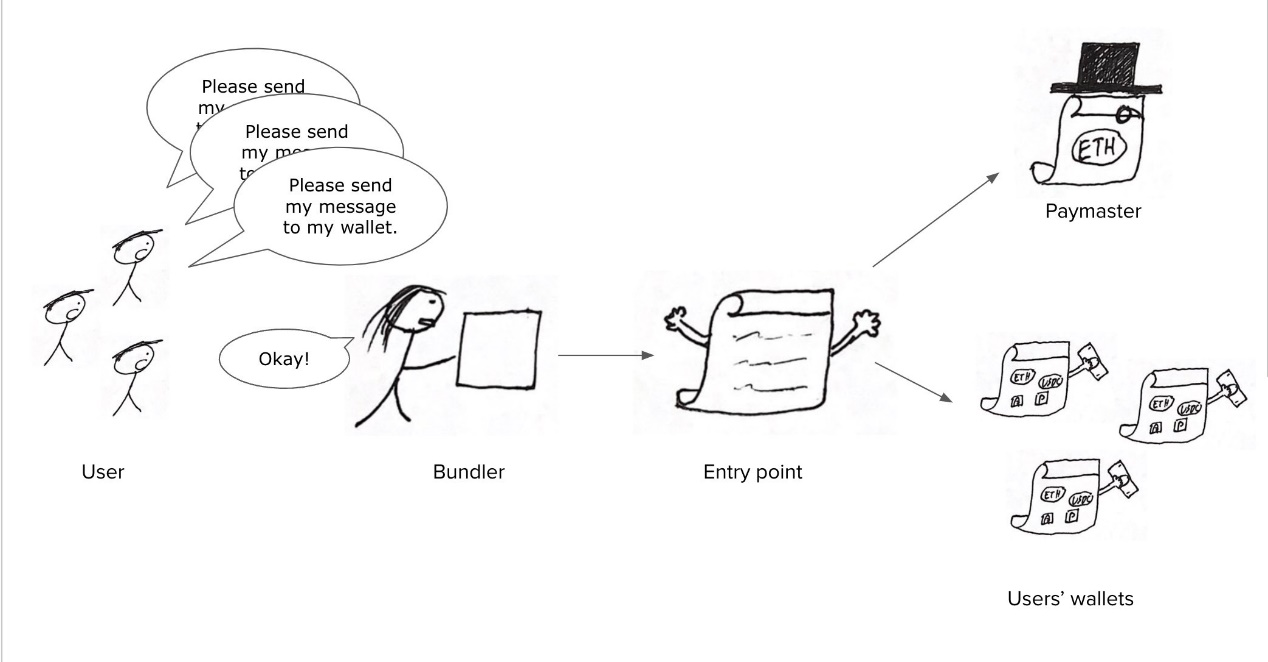

In the Ethereum ecosystem, there are two types of accounts: Externally Owned Accounts (EOAs) and contract accounts (CAs). While CAs offer enhanced flexibility and user experience through programmability, only EOAs have the capability to initiate transactions within Ethereum network. Hence, it means that you can not use a CA without an EOA.However, thanks to the introduction of ERC4337, a new Ethereum standard for smart contract accounts, user accounts can now possess enhanced smart capabilities through smart contracts, while eliminating the need for EOA-associated issues such as private keys and seed phrases.In the ERC4337 framework, bundlers use their EOAs to assist in executing transactions on behalf of users, thereby allowing users to solely control their contract accounts. In the event that a user don't have a smart contract account, Wallet Factory is available to assist them. Bundlers will pick up UserOperations (a new type of transaction in ERC4337, as it is sort of intent from users) and batched into one transaction and submitted to the Entrypoint. The Entrypoint ensures that the user's CA pays the Bundler for the gas required for the transaction. Additionally, there is an option for someone else to cover the gas costs on behalf of the user, known as a Paymaster.

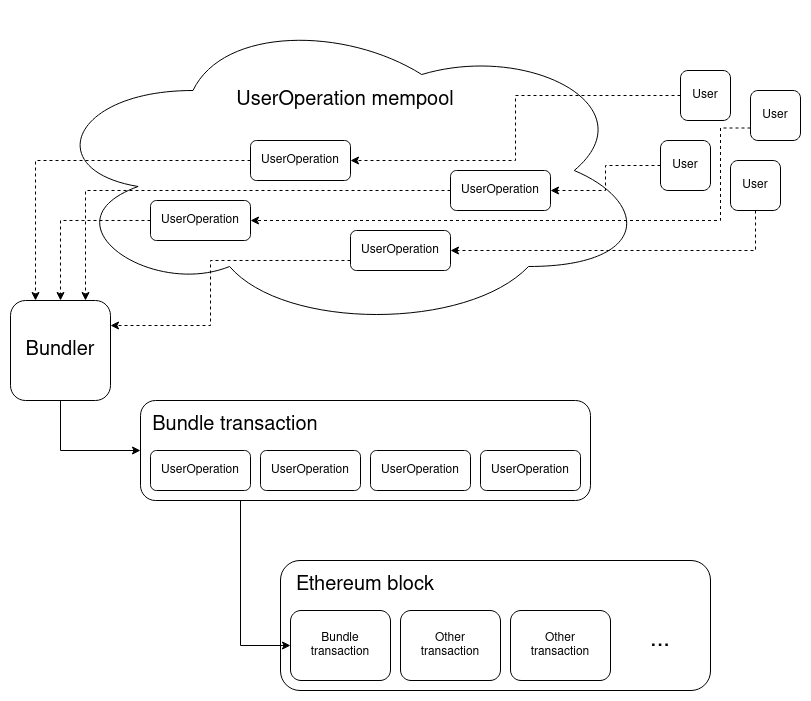

In a nutshell, the workflow of ERC4337 can be summarized as follows:

- Users initiate UserOperation containing their intended actions, along with necessary verification data and signatures.

- These UserOperation objects are then sent to a specialized mempool.

- Bundlers, who are responsible for packaging and processing transactions, compile a set of UserOperation objects into a single "bundle transaction."

- This bundle transaction is then sent to the EntryPoint contract for execution.

- On the blockchain, the bundle transaction appears as an external account (EOA) to smart contract transaction. The execution of UserOperations within the bundle is represented as internal transactions. The sender's address ('from' address) is associated with the Bundler, while the recipient's address ('to' address) corresponds to the EntryPoint contract.

- Bundlers assume the responsibility of paying the gas fees on behalf of the users. They are compensated either through funds deposited by users in the EntryPoint contract or via alternate payment options facilitated by the Paymaster.

In the upcoming paragraph, we will explore the current status of the adoption of ERC4337, six months after its launch.

Data Analysis

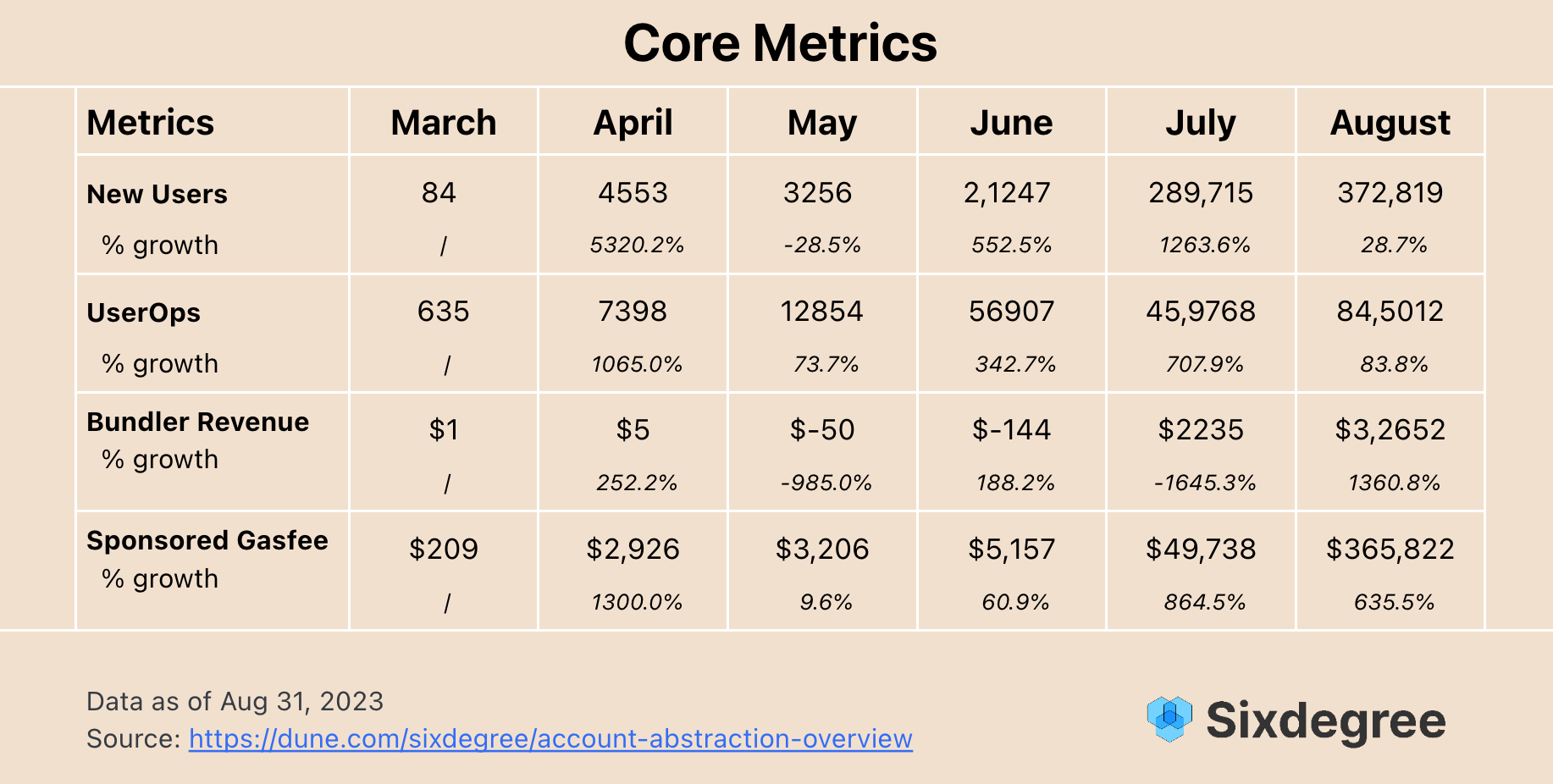

User Growth

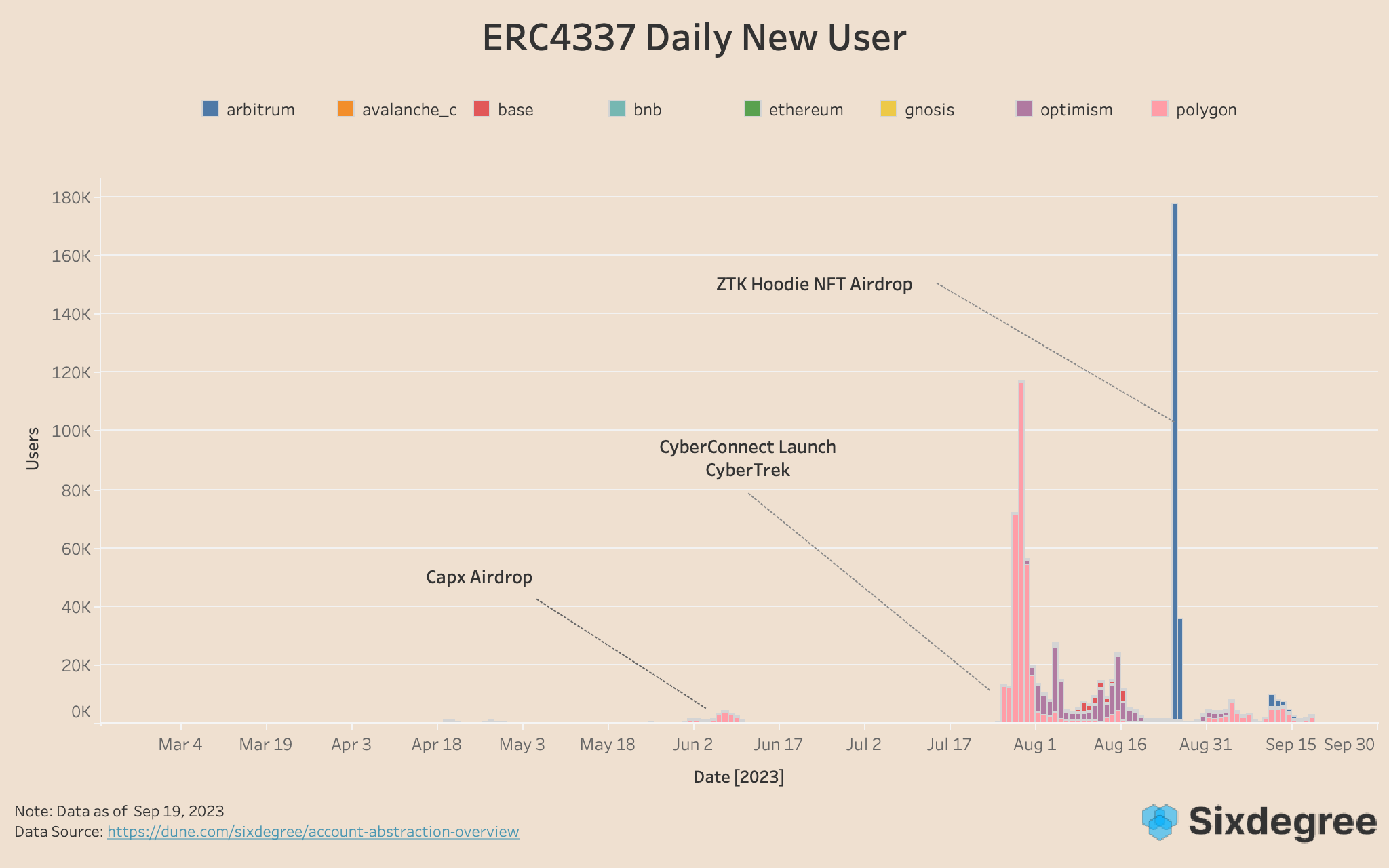

By September 19th, there were a total of 687,205 AA wallets based on the ERC4337 standard created across eight blockchain networks.

- The majority of these accounts were on three Layer2 chains: Polygon, Optimism, and Arbitrum.

- Nearly half of the users (43.9%) were on Polygon, followed by 32.1% on Optimism, and 17.9% on Arbitrum.

ERC4337 experienced significant growth in its user base, primarily driven by three events:

- The first occurrence took place on June 1st, 2023. The Capx App, a learn-to-earn app utilizes the Account Abstraction feature, which simplifies transactions even further, making it even easier for members to navigate through the platform. Although this event resulted in a relatively small surge in user adoption compared to the following two events, it marked a crucial milestone for ERC4337 and served as an excellent initial step in improving UX.

- The second significant surge in user growth happened on July 24th when CyberConnect, a decentralized social protocol, launched CyberTrek. This release introduced Cyber AA to all its users across multiple chains. Consequently, the platform witnessed a substantial influx of new users, contributing to the overall growth of ERC4337's user base.

- August 25th witnessed another remarkable event that led to a substantial increase in user numbers. The metaverse project ZTK distributed commemorative NFT Hoodies to users on Arbitrum through an airdrop. This event served as yet another catalyst for user growth.

The consistent growth in user numbers indicates a clear interest in Account Abstraction. It is a delight to observe the rapid growth in the number of AA users due to the emergence of these projects embracing AA.With blockchain infrastructure getting mature, it is expected that more consumer apps will adopt AA in the future. This, in turn, will likely result in an accelerating rate of new user growth. We anticipate exciting prospects for future user adoption and growth as Account Abstraction continues to gain traction.

User Operation

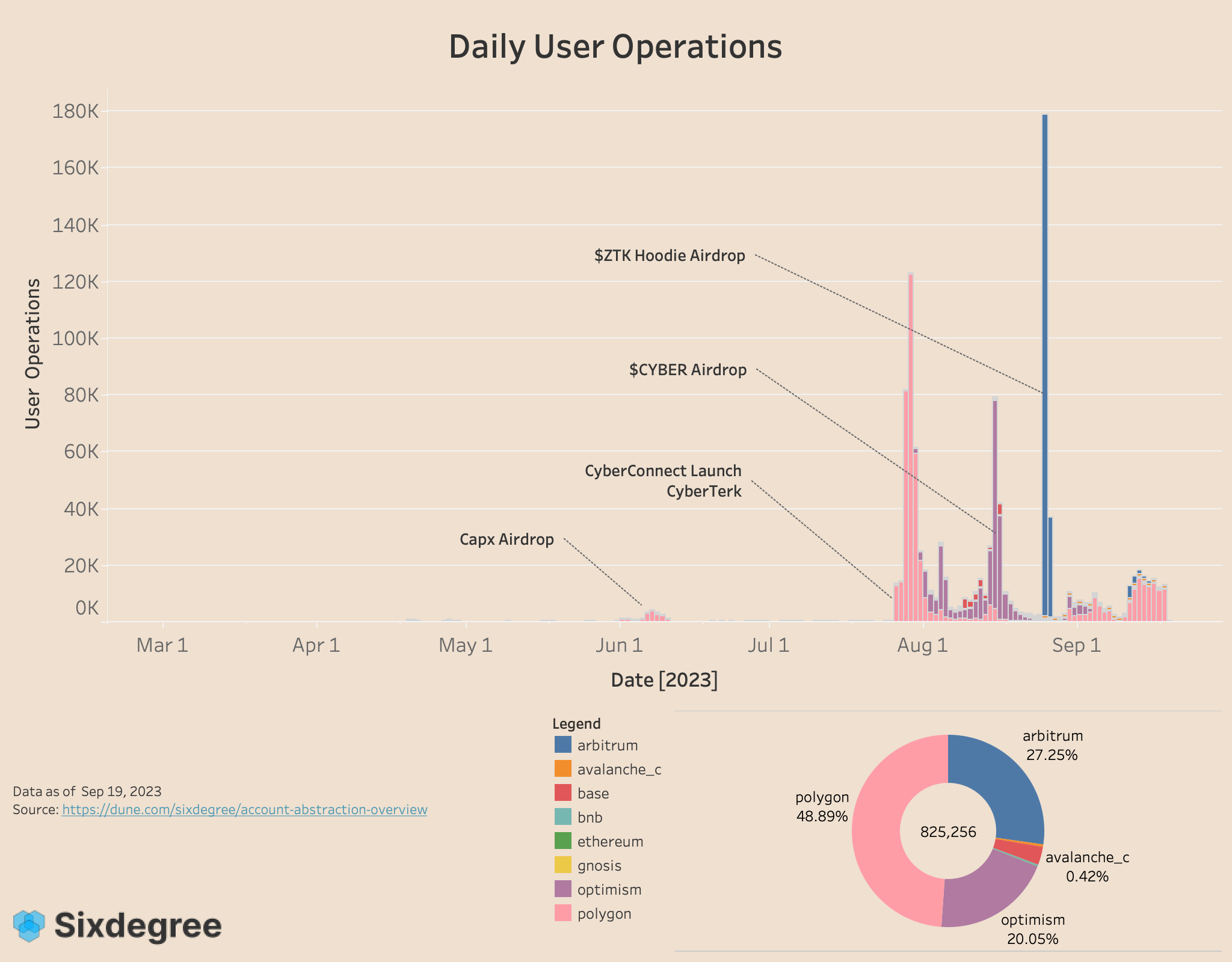

- 2 million User Operations (UserOps) were generated by all users, indicating a large user engagement.

- These UserOps can be categorized into four growth phases that have occurred.

- The initial phase saw a gradual increase driven by Capx's airdrop.

- The second phase was triggered by the launch of CyberTrek by CyberConnect, resulting in a surge of user registrations, NFT mints, and subsequent UserOps.

- On August 15th, the third phase commenced with the launch of the $CYBER token on Optimism by CyberConnect. Users can claim their airdrop with their AA wallets on Optimism.

- The fourth phase involved the commemorative NFT airdrop orchestrated by ZTK.The UserOp curve aligns with the growth curve of user base, which we attribute to the lack of consistency in user behavior solely resulting from the introduction of new projects.

Ethereum mainnet experiences fewer UserOps due to gas consumption. Layer2 solutions like Polygon, Optimism, and Arbitrum dominate in terms of UserOps.

- Polygon represents 44.11% of UserOps, followed by Optimism at 31.48%, and Arbitrum at 18.79%.

- Avalanche witnessed a significant boost of over 40,000 UserOps with the launch of the art creation platform, zeroone, on August 18th.

- Furthermore, the Base Chain experienced a modest growth period thanks to the recent Onchain Summer event.

Overall, the number of daily user activity instances has displayed a gradual upward trend. After July 26th, there was a substantial surge from an average of 700+ UserOps to a stable level of approximately 10,000 UserOps, indicating an impressive tenfold growth.

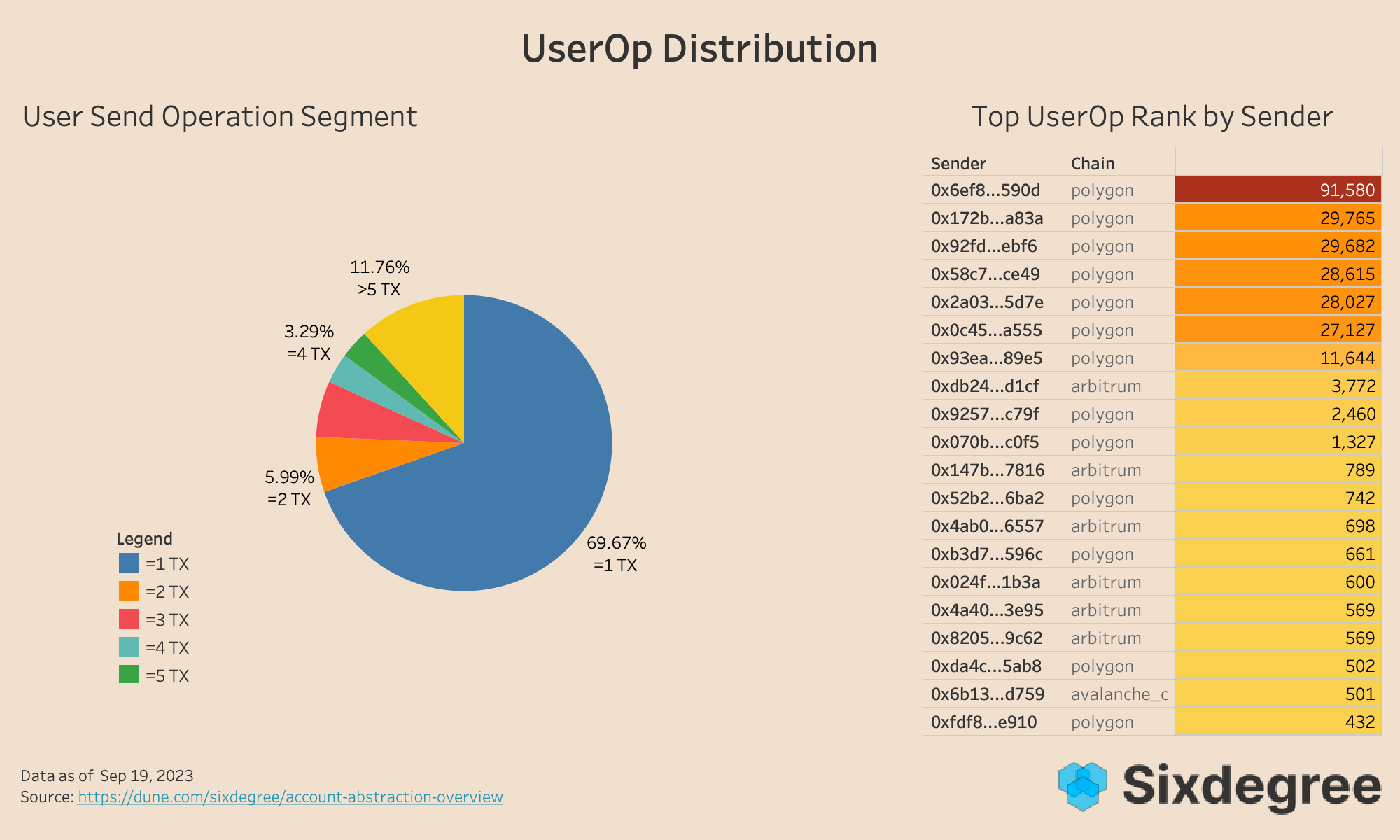

User activities

Normal users tend to have only a few interactions with the AA wallet, at a relatively low frequency. However, projects like the Capx App, drive a higher usage frequency, making it a day-to-day tool.

- The majority of users have limited interactions: Among all users, 88.24% have used their AA wallets five times or less.

- A small number of users have initiated an unusually large number of UserOps, surpassing 1,000 interactions.

- These high-frequency interactions are often associated with bulk operations initiated by specific projects. For example, the user with the address 0x93ea....89e5 stands out with over 8000 UserOps specifically related to Capx IOU Token transfers. This is likely due to the Capx airdrop.

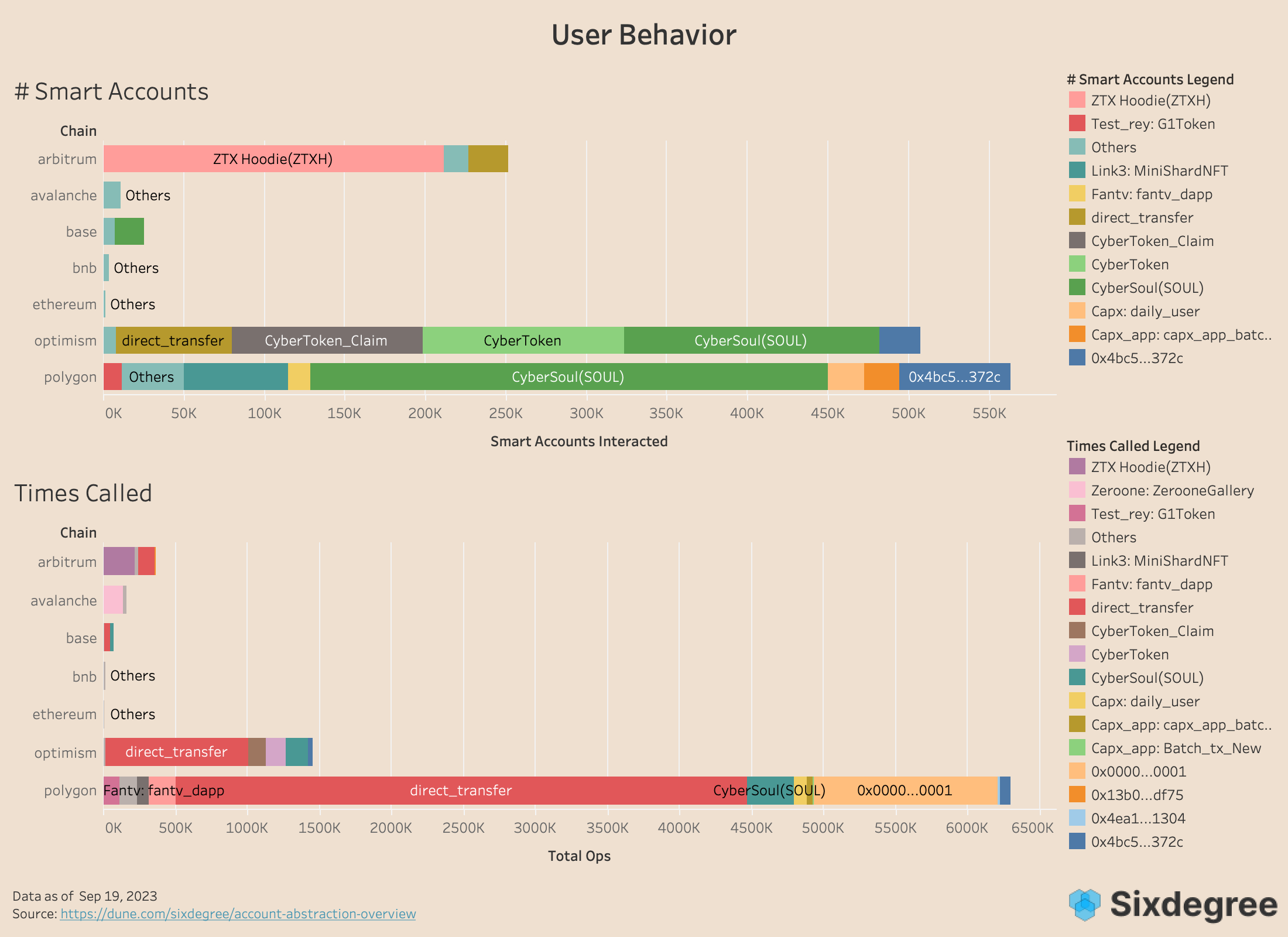

User Behavior

We are deeply intrigued by the activities carried out by individuals using their AA wallets on-chain. Note for the purpose of this analysis, we have only considered contracts with a UserOp count surpassing 100, owing to the abundance of test contracts.

- When it comes to diversity and frequency of smart contract calls, Polygon stands out among all blockchains.

- CyberConnect and ZTX are prominent smart contracts that attract the majority of users who use AA wallets.

- The most common actions performed by users are direct transfers (i.e. transferring native tokens) and NFT minting, based on the number of times each smart contract is called.

- Zoom into Polygon, by analyzing two specific figures, we can conclude that a small group of behaviour are responsible for the majority of UserOps, which primarily involve direct token transfers.

- For more details of smart contracts that users have been interacting with, please check our sheet: AA Report - Interact Contract

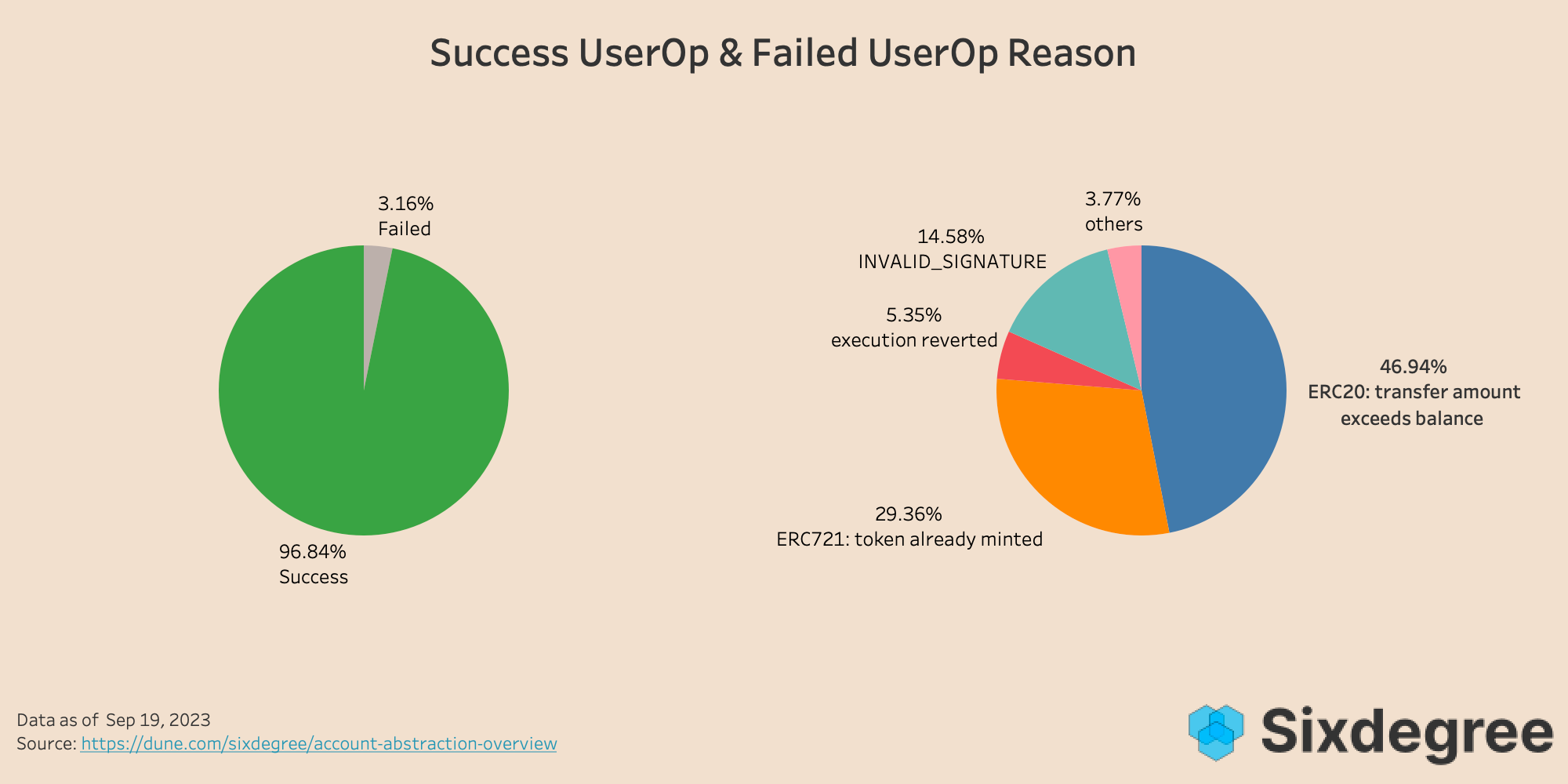

Success rate of UserOp

Out of all UserOps conducted, 96.84% are successfully completed, while a small percentage of 3.16% still encounter failures. Upon analyzing these failed UserOps, three primary reasons have been identified:

- Insufficient balance during the transfer of ERC20 tokens accounts for the majority, contributing to 46.94% of the failed UserOps.

- Another significant factor, making up 29.36% of failures, is the attempt to mint ERC721 tokens that have already been minted. This issue is particularly prevalent in the ZTK project.

- The INVALID_SIGNATURE issue is responsible for 14.58% of the failed UserOps.

Comparing these failure rates to transactions initiated by EOA, 12.1% and 5% on Polygon and Optimism, respectively, the 3.16% ratio in UserOps is relatively lower. As the Account Abstraction wallet continues to undergo improvements, it is expected that this failure rate will further decrease over time.

AA Infrastructure

Bundler

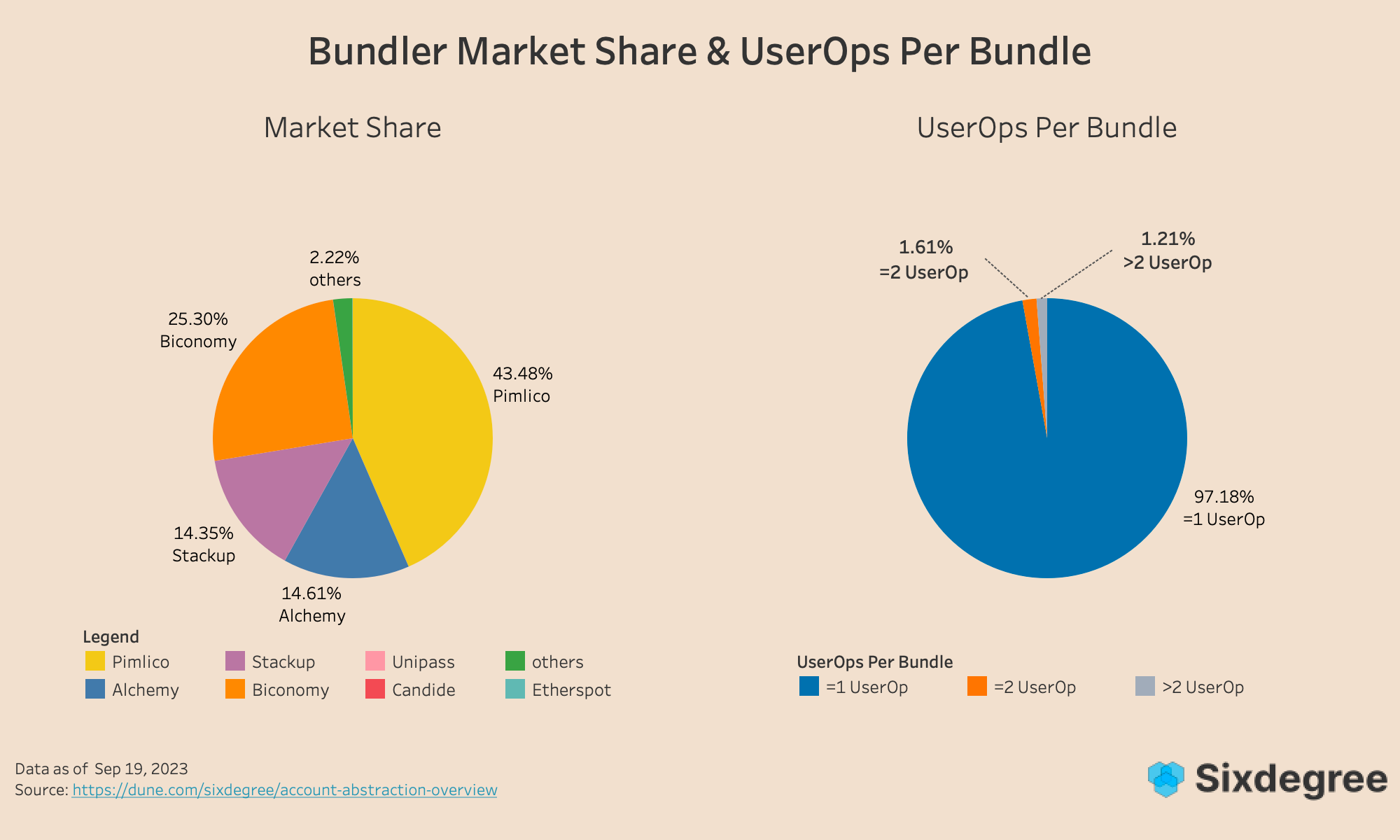

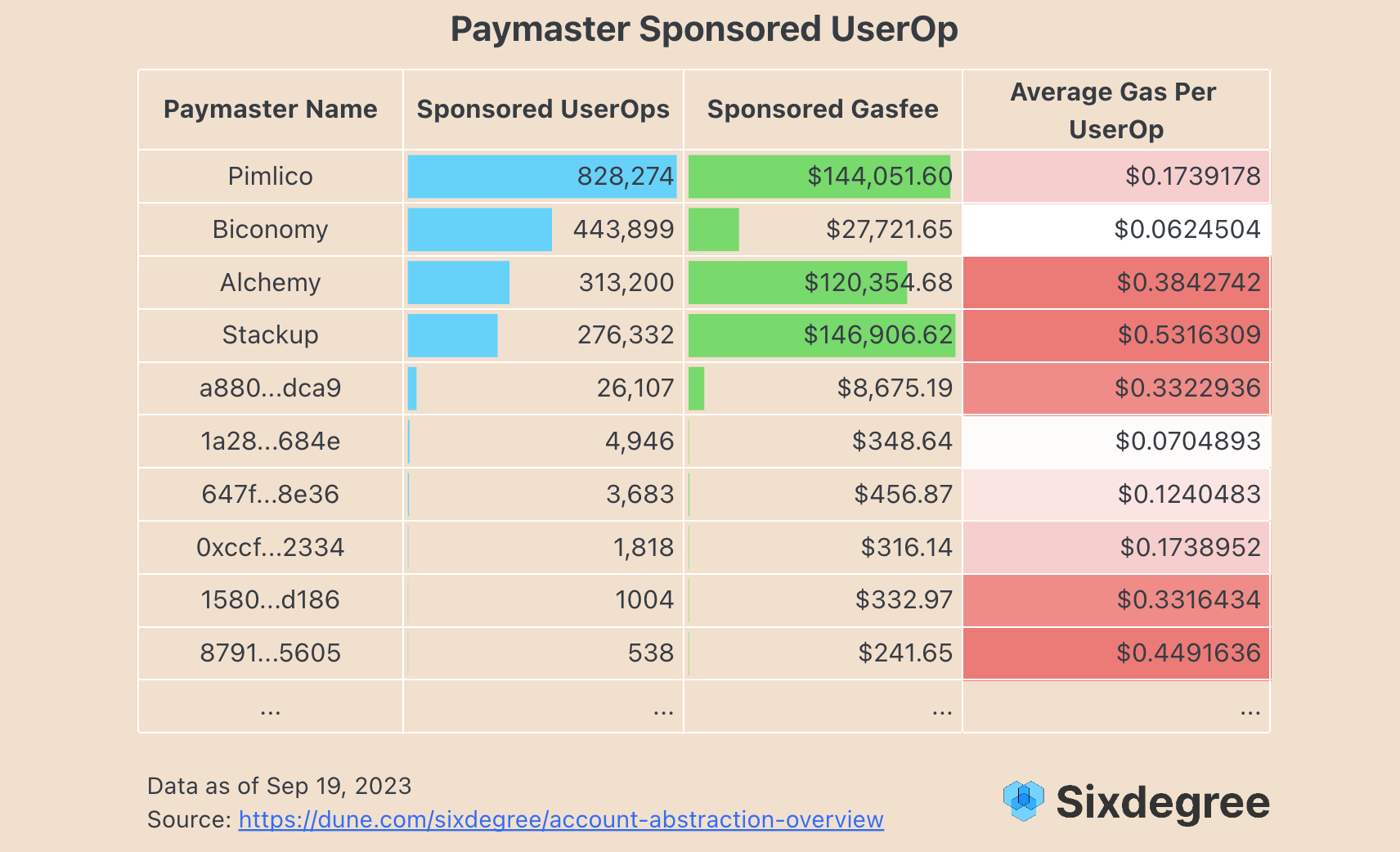

- In a group of 1,520 bundlers, Pimlico, Alchemy, Biconomy, and Stackup are the key players.

- Together, these four entities account for 97.8% of UserOps.

- Leading the bundler is Pimlico, which holds the largest market share at 43.48%.

UserOps per Bundle

- 97.18% of bundled transactions comprise only one UserOp.

- The potential benefits of bulk packaging have yet to be fully realized, leading to higher transaction costs and limiting the profits of bundlers.

While individual UserOp relaying has been sufficient given the low demand for bundling, as ERC4337 adoption continues to grow, bundlers will need to aggregate a higher quantity of UserOps in each bundle.

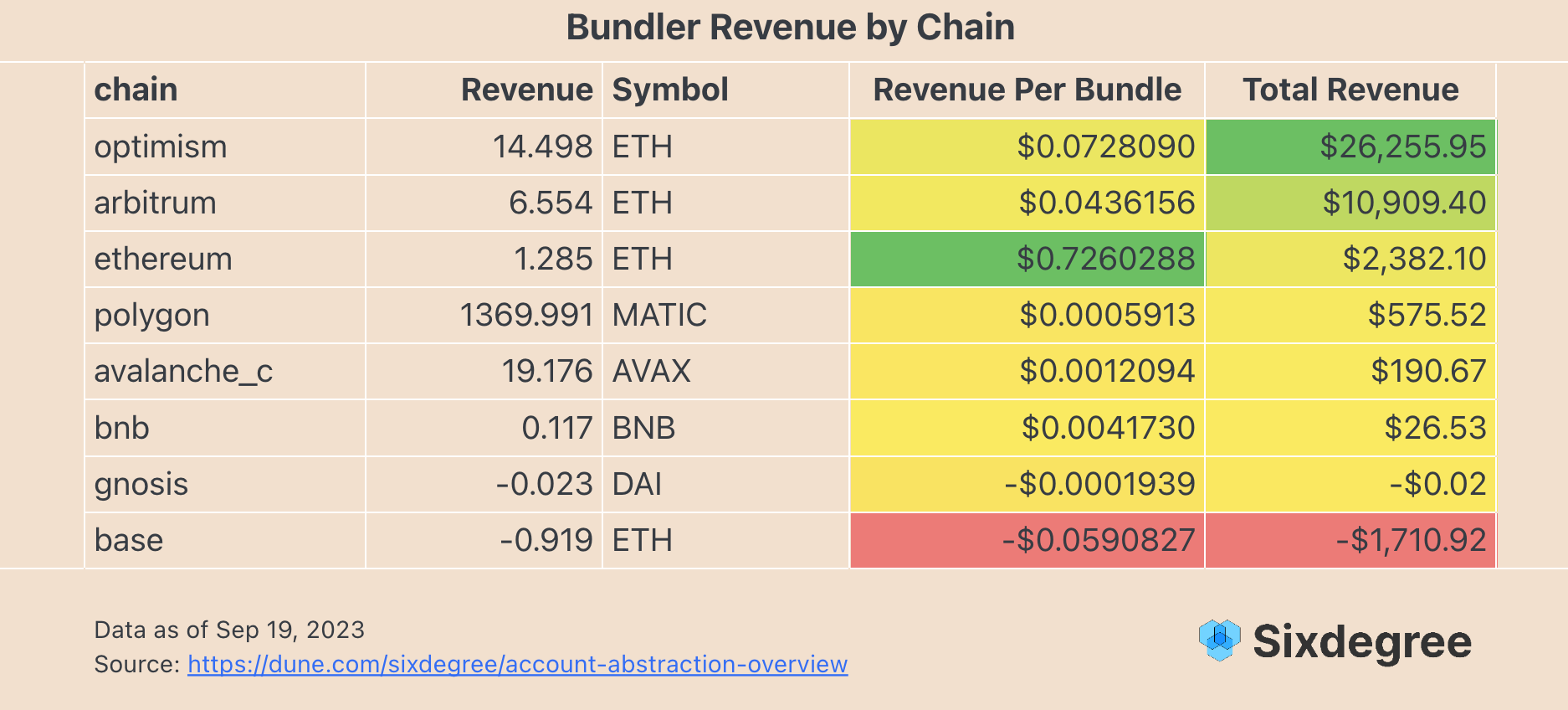

Bundlers’ Revenue

- Since the launch of ERC4337, the total profit of bundlers on the 8 chains amounts to $38,627, with the majority of profits coming from Optimism, totaling $26,256.

- Despite Ethereum having a relatively low number of UserOps, its high cost gas fees result in comparatively higher profits.

- Bundlers on the Base chain experience the highest loss, amounting to a total of $1,711.

- When it comes to average profit per bundling, it remains quite low except for the Ethereum mainnet, which generates ~$0.72 in profit. On other chains, average profits are below $0.1.

- Bundlers need to bundle more UserOps to increase their earnings.

- We anticipate a significant portion of bundlers' profits to come from MEVs, which will become more apparent as the number of UserOp increases.

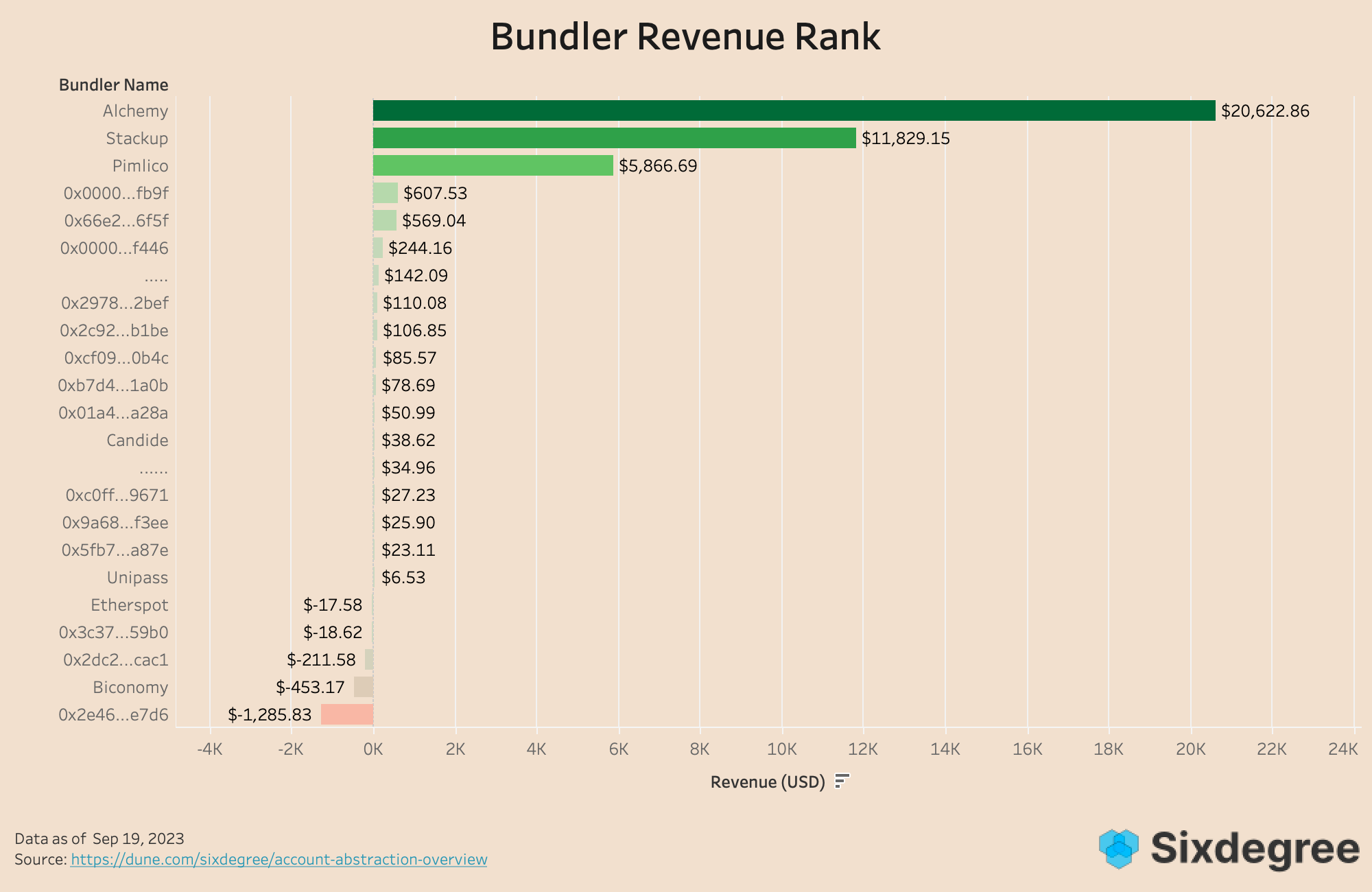

- When it comes to bundler earnings, Alchemy currently takes the lead with a total earning of $20.6K. Following closely behind is Stackup with $11.8K, and Pimlico with $5.8K.

- We observe, 10.21% of bundlers are in a profitable state, while 88.38% break even, and only 1.41% experience a loss.

- For our analysis, we classify earnings greater than $10 as profitable, earnings between -$10 to $10 as a break-even point, and earnings less than -$10 as a loss.

Paymaster

- 96% of UserOps have had their gas fees paid by Paymaster, indicating that most dApps have enabled this feature.

- A total of 117 paymasters generously sponsored $465k in gas fees, supporting ~19 million UserOps.

- In terms of market share, four major payers stood out: Stackup, Pimlico, Alchemy, and Biconomy.

- Among them, Pimlico emerged as the largest contributor, covering 43.45% of the total gas fees, which amounted to an impressive $144k.

- Stackup accounted for 14.5%, while Alchemy and Biconomy accounted for approximately 16.43% and 23.29%, respectively.

An interesting observation is that Pimlico's average gas fee per UserOp is significantly lower compared to Stackup and Alchemy. Despite paying for twice as many UserOps, Pimlico managed to achieve a similar total gas fee expenditure. This striking difference may stem from the fact that different UserOps interact with various contracts. Pimlico tends to fund a considerable number of dApp applications and direct transfers, many of which involve operations with lower gas consumption. This explains the variance in gas fees paid by Pimlico compared to other paymasters.

Wallet Factory

- Presently, ZeroDev holds the largest market share at 62.63%, primarily due to its partnership with CyberConnect.

- Following closely is ZTX, which leverages the Ethereum Foundation's official ERC4337 contract repository, particularly the SimpleAccountFactory module.

- However, there is a lack of widespread adoption of wallet applications like SoulWallet, as they currently lack on-chain use cases.

Summary

We are thrilled to witness the introduction of ERC4337, representing a significant advancement in the Ethereum account system. This report offers a data-driven analysis of the adoption of ERC4337 and an outlook on the market and its participants.Account Abstraction, although still in its early stage, has received a positive reception from individuals eager to explore its potential. However, the practical applications and possibilities that Account Abstraction offers are still unclear. As a result, Account Abstraction remains an experimental feature that people are enthusiastic about incorporating into their everyday account management.The success of Account Abstraction heavily depends on its use cases and scenarios. For example, projects like CyberConnect that have implemented Account Abstraction have experienced a notable increase in user growth and transaction volume. Looking ahead, we expect to see the emergence of more innovative applications and on-chain games within the next 12-24 months. Account Abstraction will be essential for the complex nature of on-chain games, also lowering the barriers for new users stepping into the Web3 world. We strongly believe that Account Abstraction will thrive in the future and will be a key component of the future blockchain ecosystem. Sixdegree will continue to monitor the data surrounding Account Abstraction and witness its success firsthand.

References

- https://dune.com/sixdegree/account-abstraction-overview

- ERC-4337: Account Abstraction Using Alt Mempool

- ERC 4337: account abstraction without Ethereum protocol changes

- CyberTrek: Experience Web3 with Account Abstraction

- https://twitter.com/CapxFi/status/1692882491336454153

- Everything we care about Account Abstraction- Ethereum Account Evolution brought by ERC4337

- https://twitter.com/bl00dy1337/status/1691415580539039744

- https://github.com/accountjs/aa-research

- Creating the ultimate transaction flow with Capx

- https://messari.io/report/state-of-1inch-q1-2023

- ERC4337 Address Tags by 0xkofi

Acknowledgement

This work was funded by Ethereum Foundation Account Abstraction grant (Master On-chain Data Analysis and Account Abstraction Grant ID FY23-1122 | EF ESP).

Authors

W. Julyan conducted all data analysis; W. Julyan and W. Louis analyzed the results; W. Julyan and W. Louis wrote the manuscript; Sixdegree team read the manuscript and commented on the paper.

About Us

Sixdegree is a professional onchain data analysis team. Our mission is to provide users with accurate onchain data charts, analysis, and insights. We are committed to popularizing onchain data analysis.

- Website: sixdegree.xyz

- Email: [email protected]

- Twitter: twitter.com/SixdegreeLab

- Dune: dune.com/sixdegree

- Github: https://github.com/SixdegreeLab